Many ultra-high-net-worth families have heard of the benefits of establishing a private trust company to serve as trustee of their trusts. (We prefer “private family trust company” or “PFTC”) . However, they might not understand the nuanced best practices on forming a PFTC. This blog explores some of the legal and structural issues that families should consider. For an overview of the benefits of the private family trust company please read here.

Where Should the Private Trust Company Be Located?

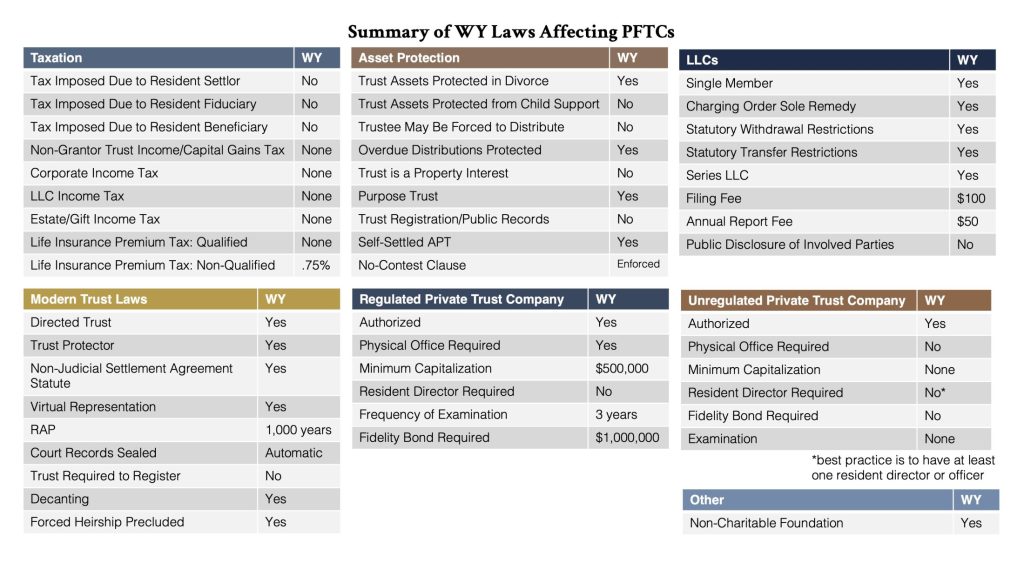

Wyoming is a uniquely attractive jurisdiction for a private family trust company. To start with, it is one of only a few states to offer unregulated private family trust companies. As a result, the cost of starting and maintaining a PFTC in Wyoming are relatively low, since there is little regulatory oversight and no minimum capitalization requirements. Further, the “Cowboy State” has a number of progressive trust laws. These include staunch asset protection statutes, a practically abolished rule against perpetuities, and decanting statutes.

A private family trust company (PFTC) is an entity designed to serve as trustee for a single family’s trusts. While the Wyoming Division of Banking regulates the closely related chartered private trust company, it does not regulate the PFTC. That said, when a family forms a PFTC, it needs to be aware of the applicable federal and state laws. PFTC governance structures should be designed so that the company will function properly as a fiduciary and thus preserve the tax benefits of the family’s irrevocable trusts.

Type of Legal Entity

Wyoming permits PFTCs to be formed as either corporations or limited liability companies (LLCs). While either entity generally works well, we usually recommend that our clients organize their PFTCs as LLCs. The LLC structure is more flexible than the corporation. It allows entities to serve on boards and committees and generally requires fewer administrative burdens. LLCs can also make a C-Corp election for tax purposes allowing the PFTCs to be taxed as corporations.

Relevant State Law

In Wyoming, the private family trust company is unregulated. The only true Wyoming statutory requirements are provided under Wyo. Stat. Ann. § 13-5-701. This statute relates to the formation of the PFTC. Specifically, the law requires that the PFTC state in its organizing documents that it is organized for the purpose of serving as trustee for a single family and that it will not engage in trust company business with the general public. Additionally, this statute requires that the PFTC provide a waiver to the Wyoming Division of Banking, acknowledging that the Division will not supervise the PFTC.

Transfer Tax Considerations

The PFTC formation process touches on federal law wherever the PFTC structure may have federal transfer tax implications. IRS Notice 2008-63 addresses the gift and estate tax ramifications of having a family-controlled PFTC serve as trustee over family trusts. In that Notice, the IRS discussed whether the PFTC, as trustee, would cause any intended completed gifts to the underlying trust, to be incomplete under IRC §§ 2036, 2038, or 2041. In the hypothetical trust structure presented to the IRS to evaluate, distributions of income and principal from the relevant trusts were subject to the sole discretion of the trustee. The IRS evaluated two separate scenarios: one where state law restricted who could serve on various committees within the PFTC; and another where the PFTC’s governing documents made the same restrictions. Wyoming law is silent regarding PFTC committees and membership, thus the second scenario is applicable.

What Constitutes a Completed Gift

In the Notice, the IRS suggested that the threshold question as to the completeness of the gift was who had the ability to exercise discretion in making distributions from the trust. In the governing document scenario, the PFTC governing documents created two committees: a Discretionary Distribution Committee (DDC), that had sole discretion in making discretionary distributions from the trusts and an Amendment Committee, that had sole authority to amend the PFTC governing documents regarding the function and membership of the DDC. The PFTC governing documents also provided that no member of the DDC may make distributions decisions for a trust for which they or their spouse is a grantor or beneficiary or for trust for the benefit of someone whom the member or their spouse owes a legal obligation of support. The governing documents also disallow reciprocal arrangements between members of the DDC.

The governing documents also stated that the majority of members of the Amendment Committee must not be related to or subordinate under IRC § 672(c) to any shareholders of the PFTC. Under this structure, the IRS reasoned that the grantors of the trust have sufficiently parted with dominion and control of the trust assets, which can be considered completed gifts under IRC §§ 2036, 2038, and 2041. Thus, grantors may realize the associated gift and transfer tax benefits of the trusts.

Our Recommendations

In the Notice, the IRS suggested that the threshold question as to the completeness of the gift was who had the ability to exercise discretion in making distributions from the trust. In the governing document scenario, the PFTC governing documents created two committees: a Discretionary Distribution Committee (DDC), that had sole discretion in making discretionary distributions from the trusts; and an Amendment Committee, that had sole authority to amend the PFTC governing documents regarding the function and membership of the DDC.

The governing documents also stated that the majority of members of the Amendment Committee must not be related to or subordinate under IRC § 672(c) to any shareholders of the PFTC. Under this structure, the IRS reasoned that the grantors of the trust have sufficiently parted with dominion and control of the trust assets, which can be considered completed gifts under IRC §§ 2036, 2038, and 2041. Thus, grantors may realize the associated gift and transfer tax benefits of the trusts.

IRS Notice 2008-63 allows family service on the DDC and Amendment Committee, so long as other criteria are met. Due to the severity of the gift and estate tax implications of a gift being deemed incomplete, we generally take a more conservative approach in designing the DDC and Amendment Committee. Generally, we will include in the governing documents that no member of either the DDC or Amendment Committee may be related or subordinate under IRC § 672(c) to any grantor or any beneficiary of any trust administered by the PFTC. The family’s trusted advisors can staff these committees so that the gifts made to the trusts are complete for gift and estate tax purposes.

Governance Considerations

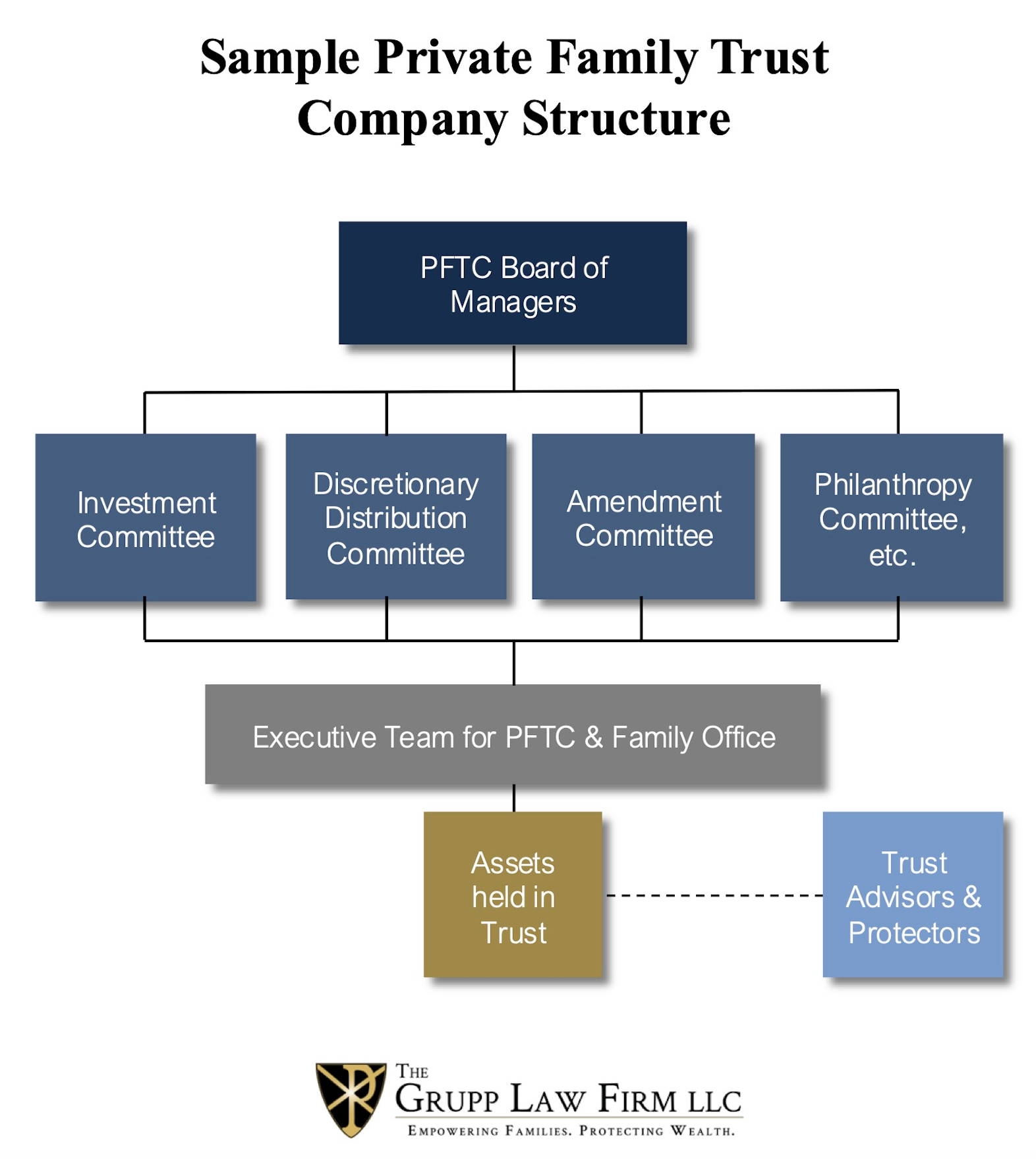

Beyond the legal considerations to forming a private family trust company (PFTC), the family must also consider the PFTC’s governance structure. In general, a governing board such as a board of directors or managers oversees the PFTC. Family members usually control this board. For more specialized tasks, the PFTC has various committees. These committees usually consist of an Investment Committee, a Discretionary Distribution Committee, an Amendment Committee, and any other committee that the family deems desirable, such as a Philanthropy Committee. The family generally controls these committees, except the Discretionary Distribution Committee and Amendment Committees. As previously stated, disinterested services providers should staff the Discretionary Distribution Committee and Amendment Committees. This will ensure the tax benefits of the family’s estate plan.

Recommended Family Involvement

The family can take on significant responsibility in the PFTC and they should carefully consider what family members or 3rd party advisors should serve where. We usually recommend that family leaders serve on the board. If the family has multiple generations of leaders or multiple branches of family, each generation or branch should have representation on the board. The Investment Committee is another important committee for family involvement. This committee directs the family’s investment activity from a centralized spot, allowing for holistic management of the family’s assets. This committee is a good spot for family leaders, family members with financial expertise, or for future family leaders looking to cut their teeth in the management of the family enterprise. The family may also want external investment advisors to serve on this board.

The PFTC can have as many other committees as the family wants. For example, many of our clients create a Family Governance & Education Committee. This committee is responsible for things such as stating the family’s vision, designing its informal governance structures, building family cohesion and culture, and educating the rising generation. Some client families also include a Philanthropy Committee or Closely Held Business Committee. These committees are responsible for directing philanthropic giving and managing the family business respectively. We usually recommend that family members with interest or skill in the relevant area sit on these committees. They are a great place for the rising generation to gain experience.

Administrative Service Providers

The above governance structures primarily deal with the high-level activities of the PFTC. A final consideration that families should consider is how to administer the day-to-day activities of the PFTC. Complex estates featuring multiple trusts designed to accomplish various objectives require significant day-to-day activities. While families may want to take on this responsibility themselves, it is generally advisable to hire an administrator tasked with carrying out the day-to-day operations of the PFTC. This prevents the family from becoming mired in the day-to-day minutiae of trust administration. The family also can gain peace of mind knowing that competent advisors are administering their estate in a professional manner. Family members can always retain ultimate oversight authority to hire and fire service providers at will.

The PFTC is an excellent chassis for advisors to collaborate with the family. In our practice, the Grupp Law Firm LLC will often serve as the “general contractor” to administer the PFTC for the family. Its roles are to 1) manage the day-to-day affairs of the family; 2) communicate with the family and lead quarterly board meetings; and 3) coordinate with the family’s other external service providers, for example a registered investment advisor or a tax and accounting professional. Therefore, the family can benefit from the expertise of a few different service providers while it keeps an integrated view of the whole.

Summary

The PFTC benefits can motivate ultra-high-net-worth families who want to retain control of their assets and have an opportunity to bring the rising generation into the governance of the family enterprise. As this article indicates, designing an effective PFTC takes significant work ahead of time to ensure that the PFTC provides the desired governance and tax benefits. At The Grupp Law Firm LLC we have years of experience in creating and designing PFTCs. Additionally, we serve as administrators and professional advisors for many active PFTCs. If you are interested in learning more about PFTCs or creating one for your family, reach out to The Grupp Law Firm LLC here.

Frequently Asked Questions on Forming a PFTC

What is a Private Family Trust Company (PFTC)?

A PFTC is a legal entity—usually an LLC or corporation—formed to serve as trustee for a single family’s trusts. Unlike institutional trustees, a PFTC is controlled by the family, allowing for flexibility, continuity, and family-centered governance.

Where should a PFTC be located?

Wyoming is one of the most attractive jurisdictions for a PFTC. It is among the few states that permit unregulated private family trust companies, meaning low start-up and maintenance costs with no minimum capital requirements. Wyoming also offers progressive trust laws: strong asset protection, 1,000-year trust duration, decanting, and favorable privacy provisions.

What type of entity should a PFTC use?

Families may form a PFTC as either a corporation or an LLC under Wyoming law. While both work, most families prefer the LLC structure because it is more flexible, less administratively burdensome, and allows entities to serve on boards or committees. An LLC can also elect to be taxed as a C-Corp.

What does Wyoming law require for a PFTC?

Under Wyo. Stat. Ann. § 13-5-701, a PFTC must:

- State in its organizing documents that it exists solely to serve as trustee for a single family.

- Disclaim doing business with the general public.

- File a waiver with the Wyoming Division of Banking acknowledging it will not be supervised.

How does the IRS view PFTCs for gift and estate tax purposes?

IRS Notice 2008-63 addresses whether gifts to trusts with a family-controlled PFTC as trustee are “completed gifts.” The IRS concluded that if governing documents restrict committee membership and decision-making in certain ways, the trust gifts can be deemed complete—allowing grantors to realize estate and gift tax benefits.

What committees should a PFTC have?

Best practices include:

- Discretionary Distribution Committee (DDC): Must be controlled by disinterested parties to preserve tax benefits.

- Amendment Committee: Should also be staffed by non-family or non-subordinate parties under IRC § 672(c).

- Investment Committee: Typically includes family leaders, family members with financial expertise, and trusted advisors.

- Optional Committees: Families often add Philanthropy, Family Governance & Education, or Closely Held Business Committees to reflect their values and assets.

What is the family’s role in governance?

Families typically control the board of directors or managers though it is best practice to have at least one Wyoming party on this board. Committees such as the Investment Committee are ideal places for family leadership, rising generation members, or external advisors. Specialized committees provide a training ground for younger family members to gain governance experience.

Why are disinterested committee members necessary?

The IRS requires safeguards to ensure grantors and beneficiaries cannot use the PFTC to exercise undue control. Having independent members on sensitive committees (DDC and Amendment) helps establish that trust transfers are completed gifts under IRC §§ 2036, 2038, and 2041.

How are day-to-day operations managed?

Families may handle administration internally, but most hire administrative service providers for efficiency. A professional administrator or law firm (such as The Grupp Law Firm LLC) can manage records, compliance, and communication, while family leaders retain ultimate oversight. This arrangement blends professionalism with family control.

What are the transfer tax considerations?

The main transfer tax issue is whether gifts to family trusts are deemed complete. If committee structures are improperly designed, the IRS could view transfers as incomplete, undermining estate planning benefits. Drafting governing documents with careful restrictions on committee membership avoids this risk.

What are the advantages of a Wyoming PFTC over a chartered trust company?

- Unregulated PFTC: Lower cost, no minimum capitalization, and greater flexibility.

- Chartered trust company: Regulated by the Wyoming Division of Banking, suitable for families that want formal oversight.

Most UHNW families prefer unregulated PFTCs for privacy, cost savings, and control.

Why should families consider a PFTC?

PFTCs allow ultra-high-net-worth families to:

- Retain control over trustee decisions.

- Ensure continuity of governance across generations.

- Educate rising family members in financial and fiduciary roles.

- Coordinate investments, philanthropy, and family governance through a unified structure.

Disclaimer: The information provided in this post is for general informational purposes only and does not constitute legal advice.