This article is an overview of the private family trust company structure and its potential benefits for families. For more information on design considerations and best practices for the private family trust company, please read How to Form a Wyoming Private Trust Company.

The Private Family Trust Company is an entity formed and controlled by a family that is specifically designed to serve as trustee for that family’s trusts.

Families have a variety of options when they select a trustee to administer their Wyoming trusts. There are two traditional options: an institutional trustee, such as a trust company, or an individual trustee, such as a family member or trusted advisor. In either case, these traditional trustees may not meet all of a family’s unique goals and objectives. Fortunately, a third alternative exists in Wyoming’s Private (unregulated) Family Trust Company (PFTC).

The Private Family Trust Company (also known as a Private Trust Company or PTC) is an entity formed and controlled by a family that is specifically designed to serve as trustee for that family’s trusts. Formerly only accessible to ultra-high-net-worth families, Wyoming’s unique legal landscape has made these entities an attractive trustee option to families of less significant wealth (~$50 million in total assets).

Private Trust Company: Overview of Benefits

The PFTC’s unique structure combines the benefits of both institutional and individual trustees, while providing an additional array of additional benefits.

The structure of the Private Family Trust Company leads to important benefits for families.

Private Family Trust Company: Structure

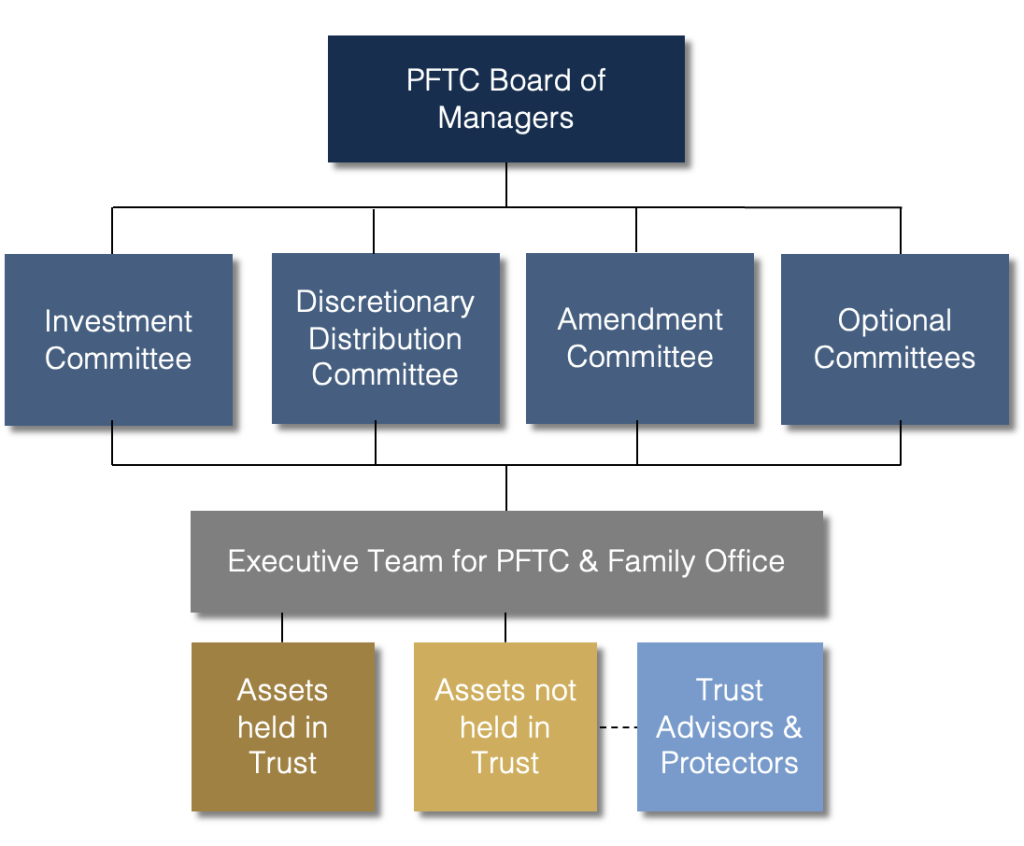

Before discussing these benefits in particular, it is important to understand the structure of the PFTC. A PFTC is generally organized as a corporation or limited liability company (LLC). Ultimate governance and oversight of the entity lies with the board of directors (in the case of a corporation) or board of managers (in the case of an LLC). The family and its legal advisors must draft the entity’s governing documents in a manner that requires family control over this governing body. The board is responsible for general oversight and governance, while various committees direct specific trustee activities.

Some families maintain a PFTC separate from an existing family office. However, we recommend embedding the family office within the PFTC. In this model, the PFTC serves as the fiduciary over the family’s trusts. It also serves as the administrator of the family’s assets and affairs not held in trust. The advantages of embedding the family office in the PFTC are holistic governance, better risk management and, and improved decision-making not just regarding the family’s financial assets, but also the family’s mission, vision, and values. On a practical level, integrating the PFTC and the family office is cost-efficient. The integration helps to prevent a disconnect between branches of the family enterprise. The flexibility of the PFTC allows the family to choose to out-source roles in the PFTC as needed. This arrangement keeps the family in the driver’s seat while taking some of the onus of administration off of family members. Most importantly, uniting the administration of the family’s trusts and day-to-day affairs enhances the ability of family leaders to promote the family’s financial resources as a gift of love intended for the human flourishing of all family members.

Investment Committee

The Investment Committee directs the investment of trust assets. Family members may control the investment committee, although this committee also frequently includes trusted advisors. The Committee executes of the family’s investments to varying degrees. For example, the committee might set up investment policy statements relating to various accounts, while a hired investment manager executes those investments in line with the policies. Or, members of the investment committee might prefer to take an active role in researching and executing investments.

Discretionary Distribution and Amendment Committees

The Discretionary Distribution Committee is responsible for making approving distribution for discretionary trusts. Due to the tax-sensitive nature of this role, disinterested parties must staff and control this committee. Fortunately, the family will retain a degree of control over the Discretionary Distribution Committee through the ability of the board to hire and fire its members at will. Similarly, the Amendment Committee also possesses the tax sensitive powers to amend the PFTC operating agreement. Disinterested parties must also staff and control this committee, under similar board oversight.

Optional Committees

The board can also establish other committees to serve specific functions. Common examples include a Philanthropy Committee or a Closely Held Business Committee. Family members can control the Philanthropy Committee and direct family philanthropic initiatives. A Closely Held Business Committee can also be controlled by the family. Its sole purpose is to manage a closely held business held in trust.

Finally, the administration of trusts generally requires significant day to day administrative activity. In the PFTC, this role is by the executive team, officers, and employees of the PFTC. They serve under the direction and oversight of the board and various committees and can be hired and fired by the family at will.

Private Family Trust Company: Benefits

The benefits of the PFTC flow from this family-controlled structure. As a trustee, the PFTC is appealing because it combines the personalization of an individual trustee with the professionalization of an institutional trustee, while minimizing the drawbacks associated with each. There are four particular areas of benefits for families.

Governance

As a business entity managed by a board and various committees, the PFTC resembles the type of professionalized management associated with institutional trustees, such as a bank trust company. Additionally, because a PFTC has a theoretically unlimited life, trustee succession ceases to become an issue. Family members can fill board and committee decisions from one generation to the next.

A common issue associated with both institutional and individual trustees is a loss of control over the administration of trusts. Under the PFTC structure, this problem is mitigated through family control over the entity. The family must, at all times, have control over the governing board of the entity and can also have majority control over most PFTC committees. This allows families to not only be in control of trust administration, but be involved in the day to day to the extent that they desire.

While certain independent parties must staff and control certain committees, such as the Discretionary Distribution Committee and the Amendment Committee, the family retains a significant level of control through their ability to hire and fire the members of these committees at will. This structure allows families to realize the many tax benefits associated with the use of trusts, without having to give up complete control.

The PFTC structure also allows for the education promotion of future family leaders. For example, rising gen members can fill committee roles within the PFTC, and gradually take on more responsibility. For example, a member of a younger generation could sit on the investment committee in a nonvoting capacity. Over time, this rising generation (rising gen) member can take on a more impactful role within this committee and other committees. Eventually they can serve on the board as the next generation of family leaders. This allows family members take an active role in managing succession and building family values for a multi-generational legacy.

Privacy

Wyoming offers families an exceptional degree of privacy across both trust and business structures. Family privacy is protected through Wyoming LLCs, which can be formed without disclosing personal information in public records. Only the registered agent of the LLC must be disclosed, maintaining the privacy of the party registering the LLC.

Unregulated Wyoming Private Family Trust Companies (PFTCs) provide an additional layer of privacy and autonomy. These PFTCs are not subject to third-party audits or regulatory oversight. Families may appoint their own administrators and manage their trust affairs privately, without outside interference.

Financial privacy is also preserved. Assets can be managed by the family and a small, trusted team of advisors rather than large institutional trustees. This arrangement allows for discretion and the ability to hold or manage unique or hard-to-value assets that institutional trustees may be reticent to accept. Together, these features make Wyoming an ideal jurisdiction for families seeking confidentiality and control.

Risk Management

Wealthy families often have a distinct investment policy that led them to their current levels of wealth. The family may have grown its wealth through entrepreneurial ventures and, after a successful sale, wishes to maintain this style of investment through concentrated stock positions or sophisticated investment strategies. Or, the family’s holds its wealth in hard to value assets, such as a closely held business. Institutional trustees are often reluctant to manage assets with the same risk tolerance that the family has. This reluctance and risk aversion is largely the result of adherence to statutorily imposed investment standards. By contrast, the PFTC’s Investment Committee implements its own investment policies. Trustee liability is internalized to the family, and so the PFTC can operate according to its own appetite for risk and its personal investment policy.

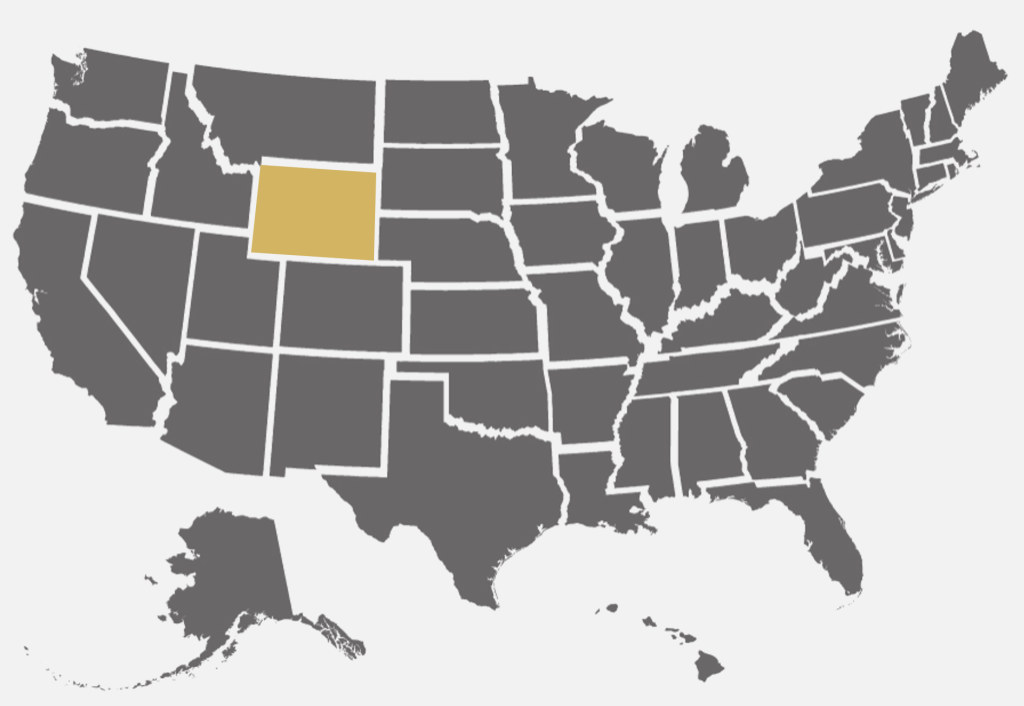

Wyoming Situs

Wyoming is a uniquely attractive PFTC jurisdiction for several reasons. First, it is one of only four states that offers families both lightly regulated and unregulated PFTCs. Second, Wyoming is one of a few states with no income tax and no capital gains tax. Third, in 2003 the Wyoming legislature extended the common law Rule Against Perpetuities to a 1000-year limit on trusts. Thus Wyoming allows perpetuity what is virtually a perpetuity. Depending upon the trust design, once assets enter a trust in Wyoming, they are free from the federal gift and generation skipping tax for a millennium.

Fourth, Wyoming has a number of progressive trust laws, including directed trusts and decanting. The family can leverage these in conjunction with the PFTC to preserve their wealth. Wyoming also provides unparalleled asset protection due to its Limited Liability Company statutes. Only the registered agent of an LLC needs to be disclosed, preserving the privacy of the beneficial owners. Additionally, Wyoming is one of only a few states that authorize spendthrift trusts. A settlor can set up a trust for him or herself to protect the assets held in that trust from creditors.

When suits arise, families find Wyoming’s courts are efficient and its legislature responsive to new developments in the industry. Families may also consider the cost of starting and maintaining a PFTC. The capital requirements and ongoing cost of a Wyoming PFTC are relatively low, making it a cost-effective and powerful structure for multigenerational wealth stewardship.

Collaboration

The PFTC can facilitate collaboration between family members, internal advisors, and outside advisors, with the opportunity of building on the strengths of all three. Through the board and committee structure, the family can determine how to manage its affairs. Generally, the most senior generation serves on the board and retains direct oversight over the entire family enterprise. However, the board may also consist of trusted advisors that can provide objective input to the controlling family members.

Not only can advisors play a role on the board or committees, but they can also carry out day to day administrative tasks. For example, advisors could execute investments either as employees of the PFTC or as externally contracted 3rd party advisors. Thus the family can have the benefit of control over investment policy. At the same time, it can leverage the expertise of professional advisors and minimizing the onus of day-to-day administration.

Conclusion

As described above, the PFTC is a bespoke entity designed to meet a family’s goals. Through its flexible governance structures, families can design their PFTCs in a manner that allows them to maximize control over trust assets, tailor investment strategies to their own risk tolerance, and foster and capitalize on the talents of family members. At The Grupp Law Firm LLC, we believe that the PFTC is an important step in the journey to family flourishing.

Disclaimer: The information provided in this post is for general informational purposes only and does not constitute legal advice.