At a Glance

- A revocable living trust leaves you in control of your assets during your life with few changes.

- A revocable living trust lets you avoid probate.

- A revocable living trust allows for incapacity planning and health care provisions.

- A revocable living trust helps ensure that your financial and health care wishes are honored. This includes contingent circumstances and unique family situations.

What Do Revocable Living Trusts Do?

A revocable living trust (RLT) allows an individual to avoid probate and plan for incapacity. However, by itself, an RLT does not provide asset protection or estate tax benefits. Instead, it often serves as the foundation for a broader estate plan that may include one or more irrevocable trusts designed for those purposes.

There is often confusion between these two broad categories of trusts:

Irrevocable Trust

A trust in which assets are transferred to an independent trustee (typically located in the state whose law governs the trust). The trustee becomes the legal owner of the assets and manages them for the benefit of the named beneficiaries, according to the terms of the trust. Irrevocable trusts are often used to achieve estate tax reduction, asset protection, and long-term legacy planning. Laws governing irrevocable trusts vary significantly by state. Many families choose Wyoming for its modern, flexible, and privacy-protective trust statutes

Revocable Living Trust (RLT)

A foundational estate planning document that allows your assets to pass outside of probate and ensures continuity of management during incapacity. The trust remains under your control during life, hence the name “revocable”. However, for that reason, it does not shield assets from creditors or reduce estate taxes. It is generally best practice to establish your RLT under the laws of your state of residence.

What is a Trust?

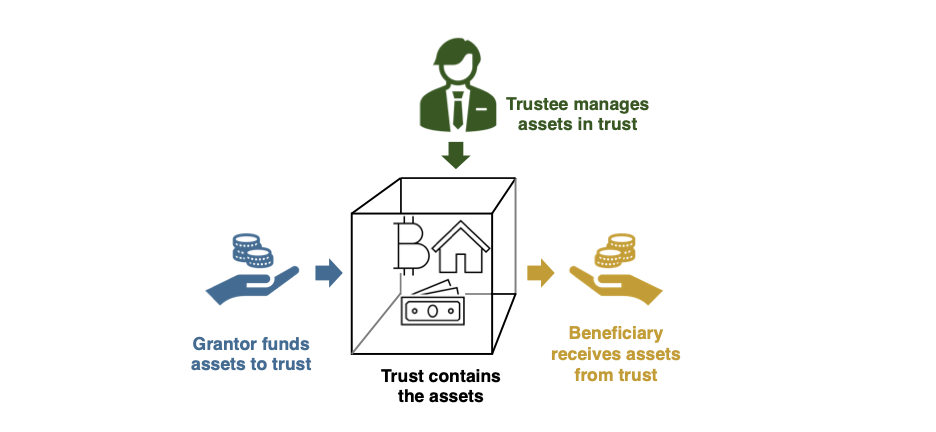

Trusts generally consist of an agreement among a grantor and a trustee for the benefit of one or more beneficiaries. These three roles are important to understand.

Grantor

The grantor forms the trust and funds the trust with assets.

Trustee

A trustee has a fiduciary obligation to manage and sometimes distribute assets for the benefit of the trust beneficiaries.

Beneficiary

Beneficiaries are persons named in the trust who will receive some benefit from the assets held in the trust.

In the case of a revocable living trust, the grantor is also the trustee and initial beneficiary of the trust. That means that when you form a revocable living trust, you can manage the assets held in the trust, and, while you are alive, you are the beneficiary. As a result, the grantor’s management and enjoyment of the assets held in trust are unchanged. The only difference is that the assets will be owned in trust as opposed to outright by the grantor. A revocable living trust is “revocable” because it can be amended or revoked at any time.

Figure: The grantor of a revocable living trust is typically also the initial trustee and is the primary beneficiary.

Generally, an RLT-based estate plan consists of:

- An RLT (married couples may have a joint RLT or separate RLTs depending on state law and other factors)

- Healthcare powers of attorney (and associated HIPAA waivers)

- Financial powers of attorney

- Pour-over wills

For more information on the human side of an estate plan and how to prepare for the particular family dynamics you have, read more here. For a list of important questions to ask your estate planning attorney, read more here.

Revocable Living Trusts vs. Wills

A properly funded revocable living trust is the primary way in which an individual can avoid probate. Probate, the formal legal process of carrying out a will, can be a costly and time-consuming procedure. When the testator of a last will and testament dies, his or her assets pass through the probate process. The probate process is unfavorable for three reasons.

Will: Disposition under Probate

First, probate can be expensive. Probate costs vary by state, but are as high as 10% of the estate’s value in some jurisdictions. A probate process will likely be required in each state where assets are held, further adding to the hassle and cost of the process. Second, in most jurisdictions, probate processes become part of the public record. This can invite litigation challenging dispositions and creditor claims against recipients of probate assets. Finally, for larger estates, the probate process can be quite lengthy, taking up to two years in some jurisdictions. On the other hand, the disposition of a revocable living trust is private and swift, and it avoids probate costs.

RLT: Disposition under a Successor Trustee

The disposition process is much different for a revocable living trust. The trust contains various dispositive provisions, similar to those found in a last will and testament. The trust also names a successor trustee, who will take over upon the grantor’s death or incapacity. When the grantor (who is also typically the initial trustee) passes, the successor trustee automatically takes control over the trust. The successor trustee is bound by fiduciary law and the terms of the trust. Generally, upon the grantor’s death, the dispositive provisions of the trust will become effective. It is the job of the successor trustee to carry out these dispositions. The trust, not the probate process, determines the disposition process.

Funding the Revocable Living Trust

Grantos might think that as soon as they sign a trust hot off the attorney’s press, they are done, will avoid probate, and have a great dispositive plan for their beneficiaries. However, after they sign the trust, families need to complete another vital step. Grantors (perhaps with the assistance of their attorney) must “fund” the trust by titling their assets to the trust. No matter how elaborate a trust is, it is useless without assets. Only assets held in the trust will avoid probate and (if in excess of the exemption amount) estate taxes. The following story shared by one of our clients illustrates the importance of funding a trust:

Fictional Case Study

The client’s mother lived in California, and her home, accounts, and other assets were all properly titled to her trust. At some point, she refinanced her home. Typically, lenders allow a refinance to close only after owners take the home out of a trust. Owners have to re-title the house to the trust after the refinance closes. However, this client’s mother neglected to re-title the home back to her trust. Unfortunately, she passed away shortly after, and the home was still titled to her individual name and subject to probate.

California is a state that has statutory attorney’s fees based on a percentage of the value of the estate subject to probate. The home’s value was over $700,000 at the time of her death. What should have been a very simple process of probating the one asset and re-titling the home to the trust ended up costing the estate $14,000 in statutory attorney’s fees. If the client’s mother had remembered (or been properly advised) to transfer her home title back to the trust after the refinance, she could have saved all of that.

The Grupp Law Firm assists families with the funding process. However, be sure to check with your attorney regarding funding.

Role of Pour-Over Wills

In some cases, probate cannot be completely avoided. The grantor may forget or fail to transfer some assets to the trust. (One of the 4 estate planning pitfalls to avoid!). At his or her death these must pass through probate. The pour-over will addresses the grantor’s remaining probate assets, if any. The pour-over will is a catch-all insurance policy that leaves all assets remaining in the grantor’s estate to the trust. Once in the trust, the assets are passed in accordance with the trust’s terms.

This process maintains privacy as the only information on the public record are dispositions to the trust, as opposed to the subsequent dispositions under the trust terms. Moreover, because there are usually few assets remaining in the grantor’s probate estate, the process can be accomplished quickly and cost effectively. Finally, the pour-over will can include guardianship appointments for minor children in the event that the grantor has any. These appointments must be approved by the probate court, but courts typically give great deference to those named as guardians in wills.

Incapacity Planning

Another significant advantage to an RLT-centered estate plan is incapacity planning. This is an overview, but for more detail, please read here.

Dealing with Incapacity: A Will

Incapacity planning is generally unavailable for wills, as wills only become effective upon the death of the testator. (Trusts, on the other hand, become effective upon signing and funding and in effect during the lifetime of the grantor.) When there is no incapacity planning, family members must petition a court to have an individual declared legally incompetent. This proceeding is invasive, potentially adversarial, and potentially embarrassing. Once a court legally designates an individual as incompetent, the ramifications that are difficult to reverse.

Dealing with Incapacity: A Trust

An RLT, on the other hand, allows for incapacity planning. It addresses the scenario by providing a private mechanism for determining grantor incapacity. This is usually takes the form of a disability panel or a two-doctor test. In either case, the determination is private and avoids a legal designation of incompetency. If the individual’s incapacity is only temporary, the disability panel or two-doctor test makes it much easier for him or her to resume control of the assets.

If the disability panel deems the grantor incapacitated, the successor trustee automatically takes over. The successor trustee will continue to manage the assets held in trust for the benefit of the grantor/initial beneficiary, meaning that the incapacitated grantor will still receive the full benefit of his or her assets. This process is automatic upon the designation of incapacity, so there is no delay in the ongoing management of trust assets, as could be the case in a judicial proceeding. Note: this ongoing administration is only applicable to the assets for which the successor trustee has authority over—the assets held in trust. Other ancillary documents govern the management of the incapacitated grantor’s other affairs.

Powers of Attorney

The healthcare power of attorney grants agency to an individual to make medical decisions on behalf of the principal in the event that the principal is unable to do so. The principal typically names a close family member to this role. Additionally, due to applicable federal law and regulation, the holder of healthcare power of attorney should be granted a HIPAA waiver so that the individual can be informed of the principal’s medical situation. This waiver can be granted to more than just the individual holding healthcare power of attorney if the principal so chooses.

The financial power of attorney is also an agency relationship. The agent with this power can make financial decisions on behalf of the incapacitated principal including the filing of tax returns, management of litigation, and the handling of other financial matters not under the purview of the successor trustee. The incapacity determination standard for this instrument can be tied to the standard applied in the revocable living trust, ensuring privacy for the principal and family members.

Revocable Living Trust FAQs

Do I need a Wyoming Revocable Living Trust?

We recommend that you form your revocable living trust in your state of residence. If you reside in Wyoming or Idaho, The Grupp Law Firm is happy to assist you with forming your revocable living trust. If you do not reside in Wyoming or Idaho, we will refer you to local counsel.

What is the downside of a revocable trust?

We believe that an estate plan founded on a revocable living trust is a better solution than a will-based estate plan in most cases because, when properly funded, it can avoid probate and distribute assets to beneficiaries without court involvement. However, rather than consider them downsides, it is important to understand what a revocable living trust does not do. For example, it does not provide asset protection or move assets out of your estate for Federal estate tax purposes. Therefore, we like to think of the revocable living trust as a foundation from which you can build out other elements of your estate plan as needed.

What is the primary purpose of a revocable living trust?

The primary purpose of a revocable living trust is to avoid probate.

What assets do not go into a revocable living trust?

We generally recommend that all your assets be placed into a revocable living trust. Assets that remain outside your trust may be subject to probate. There can be a few exceptions, and a good attorney will make specific recommendations based on your situation.

Who owns the property in a revocable trust?

The assets will be owned in trust as opposed to outright by the grantor. For some assets, this will mean that the official owner on a title, deed, or account will change. However, the grantor will experience no difference in the enjoyment and management of these assets.

Is my revocable living trust a separate taxpayer?

The income generated by the RLT is taxed as the personal income of the grantor. On the death of the grantor, assets in the RLT can be subject to transfer taxes.

Conclusion

Revocable living trusts let a grantor avoid probate, plan for incapacity, and grant powers of attorney. The RLT can serve on its own. It can also serve as the foundation of an estate plan using irrevocable trusts. These trusts may meet a variety of asset protection and tax optimization needs. Please contact one of our attorneys for more information to see if a revocable living trust is right for you.

Disclaimer: The information provided in this post is for general informational purposes only and does not constitute legal advice.