Real Wealth

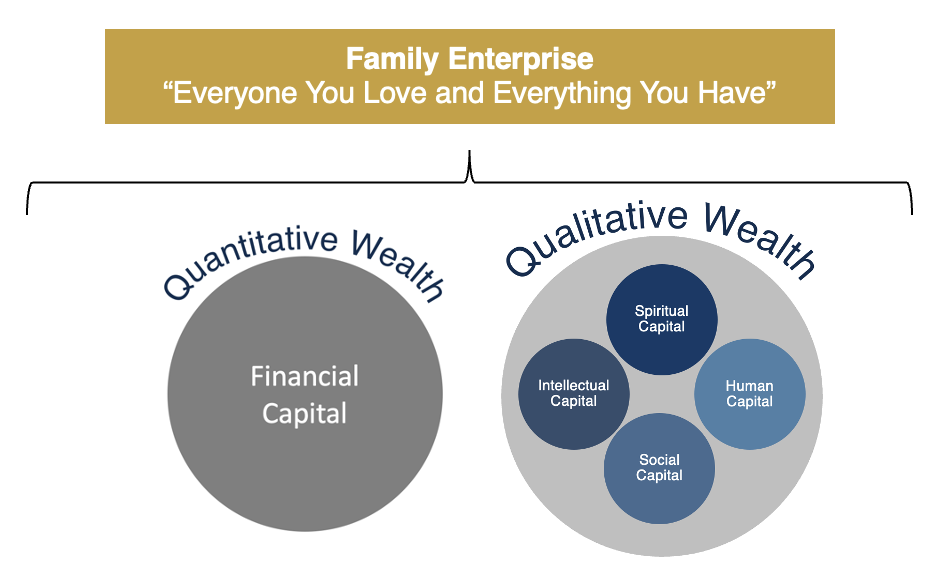

How do you measure your wealth? Most of us immediately think about bank accounts, investments, or real estate. Thinking more broadly, we might include skills we’ve acquired, a social network, and health. In fact, all of these are equally valid definitions of wealth. Wealth is really what makes us flourish as human beings. That includes not only material goods but also relationships and personal development. Wealth is from the Old English word wela, meaning both “wealth” and “wellbeing.” We like to call this “Real Wealth” playing off of Aristotle’s distinction between real good and apparent good. Real Wealth is what causes the family to truly flourish and includes more than financial capital.

Qualitative “intangible” wealth is in fact what contributes most strongly to the flourishing of a family. James Hughes identified four qualitative capitals in his book Complete Family Wealth. These are: Spiritual Capital, Intellectual Capital, Social Capital, and Human Capital. Ideally, the financial wealth of the family is used to support these four forms of qualitative wealth rather than the other way around. How the family chooses to prioritize and build these forms of wealth can determine how much Real Wealth the family has.

Qualitative Wealth

Spiritual Capital

There are two ways to define the family’s “spiritual capital.” The first is to define spiritual capital as the family’s shared values. Often families will identify strong positive traits (for example, loyalty, humility, or perseverance) that will be passed on from one generation to another. These enduring qualities are a kind of “spiritual capital” of the family.

The second is that of a shared dream for the future. Sustaining this type of spiritual capital on a family-level is difficult in our individualistic society. It takes a very strong vision to allow family members to share the same dream for the future. It is probably better understood in the context of a family dynasty, in which a business interest of family enterprise is a gravitational force giving family members a tangible reason (directed by spiritual capital) to work and dream together. Both of these can be encapsulated as a family narrative, compiled from the individual narratives of family members.

Intellectual Capital

The family’s intellectual wealth consists in the collective knowledge acquired through the life experiences of its individual members. It includes their academic achievements, professional advancement, artistic accomplishments, comprehension of personal and familial finances, as well as their capacity to both instruct and learn from one another based on their respective knowledge.

Social Capital

Social capital consists of a family’s relationships between family members and the broader community. On a basic level, relationships improve well-being and quality of life. Rather than merely viewing relationships as a means to further financial wealth, the family should seek to build genuine relationships founded on trust and reciprocity. A further way of looking at social capital is through the lens of asking how relationships can help family members and the broader society flourish through participation, giving, or volunteering.

Human Capital

Human capital consists of the family’s individual family members, their abilities, their health (physical and mental), and their ability to pursue meaningful work. Family members who have built a strong and positive sense of identity, and who are both sufficiently differentiated from, and yet synchronous with, the collective family unit contribute strongly to the Human Capital of the family.

Real Wealth: The Family Enterprise View

In order to build Real Wealth, both quantitative and qualitative, the family needs a governance strategy that encompasses “everyone the family loves and everything the family has.” We call this governance mindset the Family Enterprise View. We recommend a private family trust company (PFTC) as an ideal governance structure for the family to enact the Family Enterprise View. However, structures are not enough to build holistic wealth. The culture of the family must support qualitative wealth generation.

Building the Family Enterprise View

Families build a Family Enterprise View through the Heroic Family Journey process. The Heroic Family Journey adopts elements of the archetypical hero’s journey to fit the context of a family’s shared experience towards building a Family Enterprise.

We encourage our clients to discover and tell their own story, whether personal or the broader family history as part of this process. Because this Journey is cyclical, it can keep developing and unfolding as the rising generation gradually take control of the family enterprise, encounter new challenges, and experience transformation. By fitting the events of the life of the family into this framework, the family can gain a shared perspective that acts as the glue holding together its members.

The scheme of the Heroic Journey is relatable. All of us struggle against chaos. All of us must choose between comfortable stagnation or risky transformation. The stories we tell about ourselves are one of the most important ways to make sense of the events that take place in the family. These stories can reinforce coherence of the family from generation to generation, contextualize the differences in opinion that family members can feel, and maintain unity. A strong shared family narrative makes the family governance system “anti-fragile,” and is essential to the technical governance structures functioning as planned over time.

The Heroic Family Journey

There are four stages to the Heroic Family Journey.

1. Call to a New Way of Life (Professional Evaluation): Some event has happened that jars the family from “life as usual” and makes the family look for a solution. For example, this event could be, for example, the sale of a business or the death of a family elder. The family engages for a holistic professional evaluation of their quantitative and qualitative wealth.

2. Crossing the Threshold (Design): The family makes the decision to build a plan for a multi-generational future together. Although this takes commitment, the work is worth the reward. The family collaborates with advisors to create a plan that addresses its estate, financial, and governance needs.

3. Solving Complexity (Implementation): The family implements its plan and over time solves the complexity of governing the Family Enterprise. In addition to developing family governance and education plans, there are also plethora details relating to the integration of legal, tax, and financial planning across the various legal entities and accounts owned by the family. The family’s advisors implement the integrated plan.

4. Transformation (Administration): The family experiences transformation as both the family as a whole and its individual members lead flourishing lives. The family has a cohesive response to new challenges, transmits Wealth, and incorporates the rising generation into leadership positions. Advisors provide ongoing administration if needed. The family begins the cycle once again as they engage in new business ventures or transition the rising generation into leadership.

Summary

The Family Enterprise View allows families to consider their Real Wealth, quantitative and qualitative. Families who wish to have a multi-generational legacy would benefit from a comprehensive plan that addresses each of these. Through the Heroic Family Journey process, clients find significance in the governance structures they put in place to achieve a Family Enterprise View.

Disclaimer: The above content is for educational purposes only. You should not construe any such information or other material on this site as legal, tax, investment, financial, or other advice.