“The life of money-making is one undertaken under compulsion, and wealth is evidently not the good we are seeking; for it is merely useful and for the sake of something else.” –Aristotle, Nicomachean Ethics 1.5

A positive wealth identity differs from financial literacy, though the two are closely connected. Wealth identity refers to one’s underlying philosophy or mindset about money, the “why” behind financial decisions. Financial literacy, on the other hand, is the “how”, the practical knowledge and skills used to manage money effectively.

Wealth and Happiness

What is the feeling that you most associate with the word “money”–excitement, fear, anxiety, or something else? Does money make you happy? Your answer may indicate the health of your wealth identity.

Since society elevates the acquisition of material wealth, the unspoken inference is that more of it makes people happier. With these messages, inheritors may feel as if they ought to be happy, when in fact they face many of the same issues as everyone else. Because of the dissonance between expectation and reality, inheritors may feel that their money in fact brings more stress and anxiety than happiness and wellbeing.

The cause of their unhappiness is not the money itself, but the identity around money. Creating a positive wealth identity is therefore one of the most important things that the inheritors can do to achieve a flourishing life.

The conversation over what makes people happy is thousands of years old. Is happiness intrinsic, extrinsic, or both? Is happiness a subjective feeling, or an objective state of being better described by the words “flourishing” or “wellbeing”? The 4th century BC philosopher Aristotle had an insight that helps frame the discussion. He makes a distinction between real and apparent goods.

Real Goods and Apparent Goods

Aristotle argued that all humans want good things because they think that these good things will contribute to their ultimate desire, happiness. Happiness (eudaimonia) is what we get when we are working towards fulfilling our potential, or becoming our best selves. And so in order to achieve our potential, people need good things. Aristotle calls these “real goods.”

So far so good. Unfortunately, humans can’t always understand what they really need. People almost always misidentify what they actually need to fulfill their potential. Consequently, they fall prey to the lure of what Aristotle calls “apparent goods.” Apparent goods look like ultimate goods that will bring happiness. In fact, they are distractions that lead people further away from their full potential.

Let’s bring this back to money. Is it a real or apparent good? Certainly material wealth is a necessity at some level. Someone with too little money won’t have enough to eat, and starving doesn’t lead to happiness or fulfilling potential. On the other hand, there are plenty of examples of money enticing a person to become entitled or lazy, focused on pleasure rather than purpose. For example, the lives of lottery winners are often worse after their winnings. That also doesn’t lead to happiness or fulfillment. It seems then that money is an apparent good. It can contribute to happiness, but only if used for the purpose of some other, ultimate, and highter goal. How much money is the right amount all depends on how the money is used–whether to fulfilling an individual’s potential or stunt it.

There are many components to achieving fulfillment, happiness, or flourishing. Listing them all is beyond the scope of this article. The main point is to discover whether money is a real or apparent good in one’s life. Perhaps with the right wealth identity, someone can turn it into a real good. In this article we will look at the challenges facing the rising generation of inherited wealth and how to develop a positive wealth identity.

Challenges to Inheritors

The rising generation has been born into wealth. Unlike the first generation of wealth creators, who have had to deal with the transition to the “land of wealth” over a lifetime, the rising generation has always been familiar with material wealth. However, that guise of familiarity can be deceptive. As almost anyone born into wealth can tell you, there are an unexpected and complex web of internal and external challenges to developing a positive identity within a situation of wealth. There are three particularly persistent challenges that the rising gen may face with regard to their wealth.

Challenge 1: Responsibility

Wealth carries responsibility and thus can present an unwelcome burden to the rising generation. In order to avoid this imposed responsibility, someone might try to avoid accountability by maintaining a lack of financial literacy. Alternatively, someone might fail to deposit checks from a trust account, give or spend recklessly, or find another way to distance themselves from the money and its attendant responsibilities.

Challenge 2: Motivation

Hard work is difficult to think about when the financial reward is unimportant. It is difficult to find the motivation to do things when you don’t have to. Once members of the rising generation move into adolescence, away from externally imposed motivation and into self-imposed motivation, they may seemingly lack the ability to act in productive, meaningful ways. Alternatively, the rising generation may feel unspoken pressures about fulfilling the family legacy. Fear of “letting the family name down” may breed perfectionism and stress. It may also repress independent action in pursuit of a career path and fulfilled life.

Challenge 3: Fear

For anyone born into great wealth, it can feel as if the only direction is down. This is especially true of someone does not have the knowledge and skills to build wealth and is isolated from the means of wealth generation that the family enterprise had in the past. As a result, fear of losing a luxurious lifestyle can be greater than its enjoyment. Fear can also appear in relationships. The rising generation may fear that friends are interested in them for their wealth. Or they may be fearful that other family members are positioning themselves to take over the family enterprise for their own benefit.

Building a Positive Wealth Identity

Someone with a positive wealth identity uses wealth to build up themselves and their community. It is a solution that counteracts the challenges listed above. The solutions for these common challenges are actionable for inheritors on their own. They may only provide part of the solution; however, at best they may allow the inheritor to form a positive wealth identity in order to use material wealth to fulfill their potential as human beings.

Strategy 1: Assess Your Money Mindset

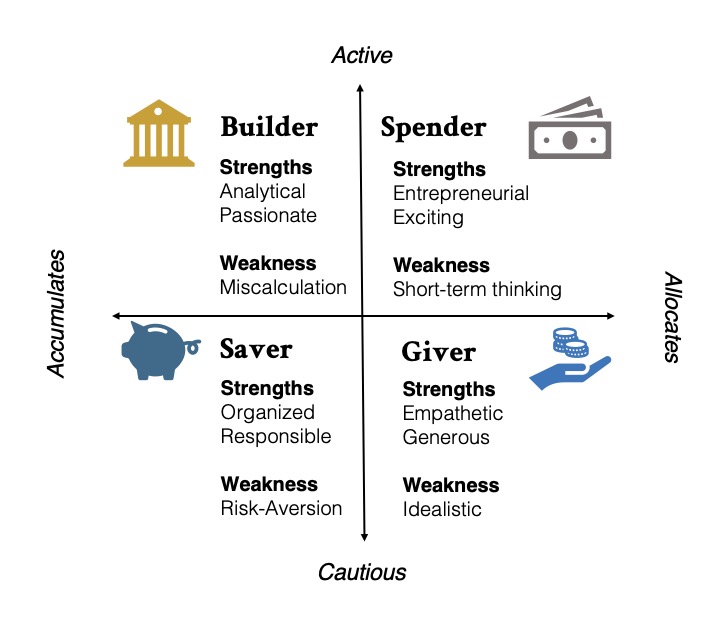

A money mindset determines the default actions someone takes with money. There is no right money mindset. Each has its weakness. The goal is to be able to minimize the weaknesses of any particular mindset. For example, if someone who is prone to spend, could consider having an automatic withdrawal from their account to savings at the beginning of the month. That way they do not need to feel insecure about their particular method of approaching money. The money mindset tool also allows someone to identify and capitalize on their strengths. If someone has a giving mindset, they may want to serve on a Family Foundation or establish some other organized means of philanthropy.

The follow up to the money mindset tool goes a little deeper to determine the emotions someone might have around money.

- Is money a significant or minor aspect to character?

- Is money a path to fulfillment, a burden, or an embarrassment?

- Does money lead to tension or conflict in relationships?

- Do you avoid keeping up with what’s happening to your money?

- What word comes to mind when you think about money?

What if the answers to the above are mostly negative? The good news is that there are good and increasing options available. Personal coaching can greatly improve the psychological health and confidence of inheritors. Additionally, it is now easy to find communities of like-minded peers. For example, Family Office Exchange (FOX) hosts leadership forums and programs for the rising generation. https://www.familyoffice.com/learning-programs/rising-gen-programs. Programs such as these provide opportunities to build a positive wealth identity through relationships, skills, and coaching.

Strategy 2: Form a Personal Mission Statement

Second, inheritors might consider forming a personal vision, mission, and values statement that starts with putting words around their personal identity. This independent identity can incorporate wealth but should be independent of wealth. The exercise of finding an identity starts with a search as to what one’s unique way of looking at the world is, and what they would like to achieve. However, it is important to avoid unrealistically ambitious goals or get lost in the complexity of deciding minutiae of identity and future goals. It is better to start with small, approachable steps to begin to frame an overall outlook in words. It is easy to refine this later—the hard part is starting.

Inheritors may also want to consider an altruistic or philanthropic purpose to their personal mission. Philanthropy is both a practical and a philosophical solution to the tensions that inheritors may feel about their wealth. On the practical side, donating time or money to social causes, the arts, or community service (or perhaps a Family Foundation that does one of these) tends to give a sense of purpose and abate the emotional struggles that can accompany wealth. Additionally, philanthropy helps build the community relationships and family identity that allow wealth to persist across generations.

Philosophically, altruism fills a deep need in the human psyche and strengthens the whole community. Giving can create genuine human relationships and a connectedness across ages, classes, and nationalities. As people give, they tend to discover that they and their wealth are only a part of the bigger picture of a particular cause. They also begin to realize that flourishing lies not just in material wealth—it consists in personal fulfilment and in activity on behalf of others. Philanthropy helps wealth become a “real good”—something that can be used to become the best versions of ourselves.

To learn more about starting a private foundation and forming a philanthropic mission statement, contact The Grupp Law Firm LLC here.

Strategy 3: Discover Your Personal Legend

In their paper Acquirers’ and Inheritors’ Dilemma, Dennis Jaffe and James Grubman cite a study showing that “…psychologically healthy individuals framed their life stories as meaningful narratives” (19). Inheritors who struggle to form a positive identity around wealth might consider taking time to structure their life as a story. They can do this on their own or with a family governance and education advisor. Framing your life as a meaningful narrative gives you positive agency and purpose. It also helps filter the noise of daily events to help you focus on what is significant.

Positive agency is the ability to act and to change the world for the better. A lack of agency creates the feeling of being at the hand of fate, and that actions do not actually impact results. While random events do seem to happen—both good and bad—it is important not to get into a negative feedback loop regarding agency. If someone does nothing and nothing happens, it is easy for them to continue to get more discouraged. An effective way someone may counteract this is by placing their actions within the context of a personal narrative. When someone envisions themselves as a protagonist on a journey, challenges become are opportunities to engage agency rather than random catastrophes.

Stories have an end point. When someone creates a life narrative a narrative, they may discover the trajectory of where they are headed or would like to be headed. Even if the final endpoint of the journey is a mystery, a narrative may clarify what they shorter-term goal is. In this way, a meaningful narrative creates the “why” for someone’s actions. A “why” helps separate what is relevant to progress and what is just noise. Being able to separate important events, activities, and actions from unimportant ones can free up mental and emotional energy.

For more information on how to create a meaningful narrative of life events, read more here.

Summary

Creating a positive wealth identity is all about understanding yourself, your goals, and your story, and then using wealth to grow these areas. Through this process, inheritors have the ability to use their wealth to fulfill their own potential and benefit their communities.