- Family Office decision-making can have generational impacts.

- Family Office Executives can benefit from using probability in their decision-making process.

- There are some ways to incorporate probabilistic thinking to counteract cognitive biases when decision-making.

Family Offices face complex decisions every day. These involve not just financial matters, but also multi-generational family relationships. The family office is responsible for thinking decades into the future to allocate resources and manage dynamics. These decisions can have multi-generational consequences.

For any of these decisions, a simple binary is not the most effective way of predicting outcomes or making choices. Instead, it is more helpful to use probabilistic thinking, i.e., “What are the odds?”. Probabilistic thinking could be helpful in formulating a strategy around the following questions:

- What is the probability that the global economy will continue to rise over the next two decades?

- What is the probability that the rising gen will be able to get along and share responsibility in the governance of the family enterprise?

- What is the probability that a major family disagreement forces a split of the family’s operating business?

How to Learn from the Past

Many family offices will have quarterly or annual reviews to track the performance of decisions made. While this is an excellent standard practice, it may be subject to hindsight bias, in which everything looks simple and clear in retrospect. This hampers the value of analysis of past decisions to inform present and future decisions. Here is an example of hindsight bias at work both for positive and negative outcomes.

Example of Hindsight Bias for a Positive Outcome

A family office may have seen year of growth due to luck rather than good governance. However, the executive might declare, “What an incredible quarter of growth! There was no way the new product could have not been a tremendous success.”

Example of Hindsight Bias for a Negative Outcome

A family office may have perceived a market as normal. However, after a stock market decline the Chief Investment Officer might declare, “The signs of this recession were very clear. We are confident in our ability to detect the next market bubble.”

Hindsight bias makes a tight connection between the decisions they made and the outcomes they achieved. Mostly, hindsight bias remembers when things worked out favorably. It also misremembers the essential uncertainty at the point of decision-making.

Here is a thought activity to discover If hindsight bias is at work. Consider some of the more important decisions the family office has made that turned out very well and some that did not go so well. Now ask:

- What exactly was the reasoning behind those decisions?

- Was the information held at the time inaccurate?

- Were the goals at the time unrealistic?

Almost anyone who has gone through this kind of exercise can begin to understand what decisions were made well and which were not. One can also begin to discover whether the impact of the decision-making succeeded or failed. The future can foil even the best-laid plans. However, by using probabilistic thinking the family office can try to quantify and plan around the fundamental uncertainty of the future.

Incorporating Probability into Family Office Decision-Making

There are three aspects of probability that may prove helpful for family office decision-making. They are:

- Bayesian Thinking

- Fat-tailed curves

- Asymmetries

Bayesian Thinking

Bayes’ Theorem, developed by clergyman and intellectual Thomas Bayes in the 18th century, provides a mathematical framework for updating beliefs or probabilities based on new evidence. It allows someone to revise initial beliefs, known as priors, in light of new information. This improves the accuracy of predictions or assessments.

Here is an example of Bayes’ Theorem in action for a basic decision. Imagine you are thinking about having bacon for breakfast when you come across a recent study indicating that regular bacon eaters have a 20% increased risk of heart disease. At first, this statistic might set off alarm bells.

However, by applying Bayes’ Theorem, you decide to reevaluate this information against your initial assumption of a 10% general risk of heart disease. After integrating this prior probability with the new data, you calculate that the actual risk of heart disease from eating bacon adjusts to about 2.92%. This indicates to you that bacon presents a moderate risk to your health. However, it is not as severe as the statistic initially seemed.

On the other hand, new data, when added to prior information, might reveal an important negative trend. A 1% monthly decrease in a stock portfolio might not appear too catastrophic in isolation. But when integrated with prior knowledge–that ten out of the previous eleven months have also shown a 1% decrease in portfolio value–this new information confirms a very worrying trend.

Bayesian thinking is essential for family offices as it refines decision-making in the face of financial uncertainties. This method allows for the update of beliefs with new evidence, improving predictions and risk assessments. It aids in discerning significant trends from noise, crucial for navigating investments and strategic planning. By applying Bayesian principles, family offices can better manage risks and opportunities, ensuring more resilient and informed strategies for sustainable success.

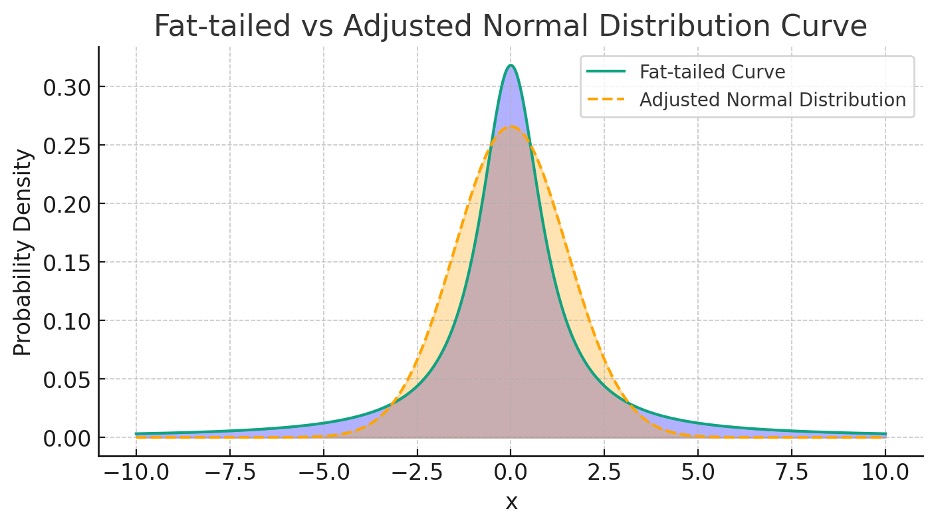

Fat-Tailed Curves

Many things in life follow a normal distribution curve. In a normal distribution, most things happen close to the average, and very surprising outcomes are quite rare. For example, distributions of test scores or human height across a population show limited variability from the mean and have bounded extremes. You are not going to come across a human 20 feet high or a test grade better than perfect.

When we hear about averages, it is tempting to think that results will always follow a neat distribution curve with limited variability. However, this is not always the case. Fat-tailed curves are a way to describe situations where certain events are unlikely but exhib it extreme variability. This is important because it helps us understand and prepare for big surprises that could have a huge impact.

Understanding fat-tailed curves is important for making good decisions, especially when it comes to managing risks and planning for the future. The concept tells us that we should not just focus on the most likely outcomes but also prepare for the extreme ones because they can and do happen. For example, while market returns show a mean of 7% or 8% over the long term, large volatility often occurs, with most of the positive and negative returns taking place over a few days. Fat-tailed curves remind us that big market crashes, natural disasters, or big economic changes are possible and that the impacts can be more extreme than we think.

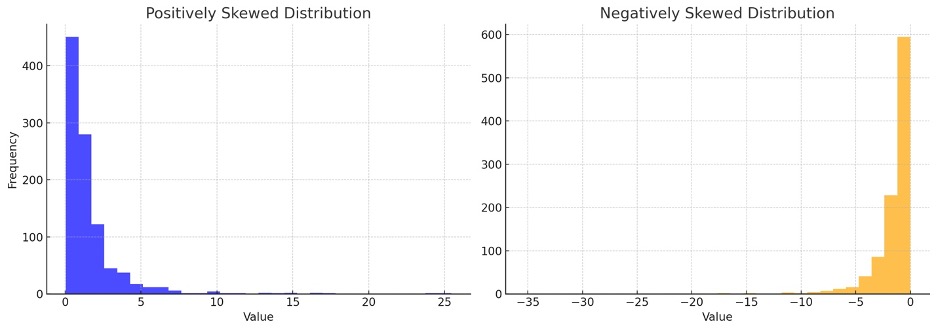

Asymmetries

How good is your data? Are you properly estimating the chances of a good outcome vs. a band outcome? The statistical concept of asymmetry relates to the degree to which a distribution of values deviates from a symmetric shape. In a perfectly symmetric distribution, the mean, median, and mode are all the same. The two sides of the distribution mirror each other. However, in real-world markets, distributions of returns often show asymmetry—meaning they lean more heavily towards one side or the other.

Shane Parrish of Farnum Street explains how this might apply to everyday decision-making:

If you look at nicely polished stock pitches made by professional investors, nearly every time an idea is presented, the investor looks their audience in the eye and states they think they’re going to achieve a rate of return of 20% to 40% per annum, if not higher. Yet exceedingly few of them ever attain that mark, and it’s not because they don’t have any winners. It’s because they get so many so wrong. They consistently overestimate their confidence in their probabilistic estimates.

Far more probability estimates are wrong on the “over-optimistic” side than the “under-optimistic” side. You’ll rarely read about an investor who aimed for 25% annual return rates who subsequently earned 40% over a long period of time. You can throw a dart at the Wall Street Journal and hit the names of lots of investors who aim for 25% per annum with each investment and end up closer to 10%.

For family offices, grasping the concept of asymmetry in market returns is vital for safeguarding and growing wealth over generations. This statistical insight compels family offices to reevaluate their investment strategies, acknowledging that returns can significantly deviate from the average, leading to unexpected outcomes.

Black Swan Events

The Black Swan Event is another way of thinking about uncertainty and probability. Nassim Taleb coined the phrase to describe an event that happens outside our framework of how the world works. Humans are very good at absorbing information and using it to construct a framework of reality. This framework, in turn, helps us to predict further events. However, it is not very good at predicting an event that is a “paradigm shift” outside of the existing framework.

For example, the inhabitants of Eastern Europe could never have predicted the Mongolian invasion of the 13thcentury. They were not used to the unprecedented skill and speed of Genghis Khan’s army. Large natural disasters, like volcanos and tsunamis, can also be black swan events, for example, the 2011 tsunami that severely damaged the Fukushima nuclear plant in Japan.

There are three characteristics of black swan events:

- Unpredictability: Black swan events are typically unforeseen or considered highly improbable based on existing knowledge and models.

- High Impact: These events have a significant impact on society, economies, or systems, causing widespread disruption and potentially altering the course of history.

- Retrospective Explanation: After the event occurs, people often attempt to rationalize it or explain why it happened, even though it was not predicted or adequately prepared for.

When a black swan event occurs, it is important to come to terms with the negative impact and to adjust one’s framework for the future. This is the opposite of hindsight bias, in which one retroactively imagines that a previous framework predicted or could have predicted an event that it in fact did not.

In the context of the family office, financial protective measures are probably better quantified and protected than interpersonal dynamics. Although a black swan event could look like a financial crisis or a sovereign credit default, it might also look like the matriarch or patriarch suddenly dying, an acrimonious split between two rising gen siblings, or divorce among key decision-makers.

Taleb coined the term “anti-fragility” to describe a strategy to prepare for a black swan event. Anti-fragility is resilience and adaptive capacity. The damage will still occur, but an anti-fragile family office will be able to bounce back rather than be destroyed. Furthermore, it will become stronger through the experience. Below are some ways in which a family office could develop anti-fragility.

Diversification

A family office could allocate portions of its portfolio to different asset classes and investment strategies. This might allow for a downturn in one market or sector not to jeopardize the family’s overall wealth. Additionally, the office could use multiple custodian banks to mitigate the risk associated with the failure of a single financial institution.

Narrative-Based Governance

Families can achieve resilience through hard times and conflicts by having synchronous narratives. Each family member contributes their own story and understanding of a shared identity to the whole. If these individual narratives broadly flow together, the family is able to re-center and recalibrate in the face of disruption.

Decentralization

Allow for redundancy among decision-makers and a clear succession plan. This means that no one person will be indispensable for the family office to operate. Decentralization doesn’t mean that there isn’t a clear chain of command or a strong executive, just that multiple people can take over key roles if need be.

Summary

Integrating probability into family office decision-making is crucial for navigating the complexities of financial and familial dynamics. This approach encourages evaluating risks and opportunities based on likelihoods, preparing for unpredictable economic trends, internal family dynamics, or potential black swan events. It emphasizes the importance of calibrating confidence accurately, incorporating flexibility, and developing strategies that make the family office not just resilient but anti-fragile—capable of thriving amidst uncertainties. Such a mindset is essential for family offices aiming to preserve and grow wealth across generations. It underscores the need to stay adaptable and consider a broad range of outcomes in strategic planning.

Disclaimer: The above content is for educational purposes only. You should not construe any such information or other material on this site as legal, tax, investment, financial, or other advice.